Automated Sales Order Creation in SAP

Sales Order Creation - Highlights and Benefits

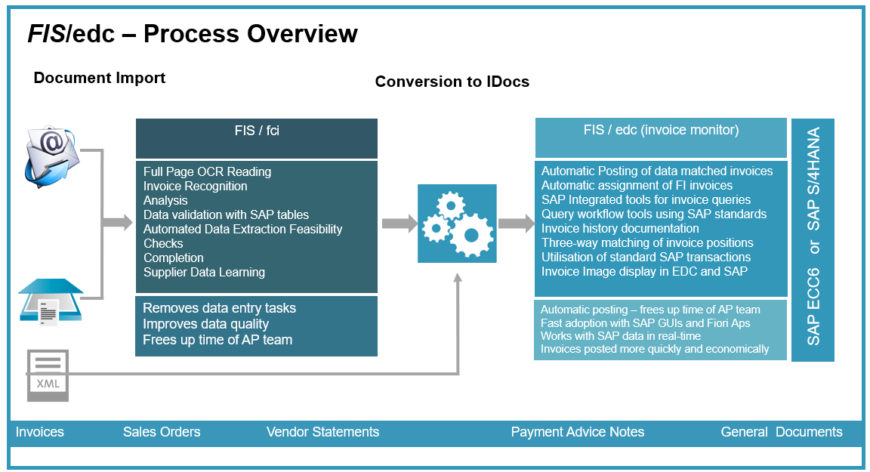

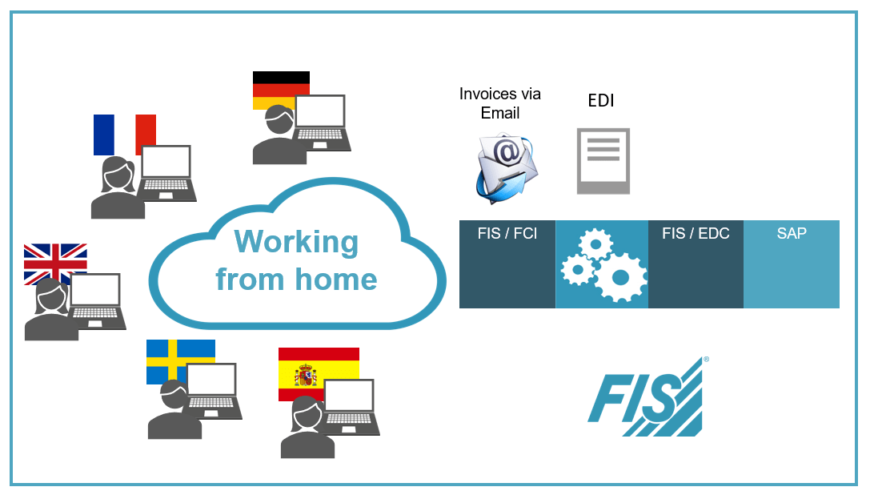

Automating sales order creation in SAP can be achieved by combining a number of technologies.

FIS technologies reduce manual tasks and ease time pressure on the accounts receivables team.

As a result, the administration burden is reduced, as the process of sales order creation is made more economically.

Automatic Data Extraction - no data entry

Sales orders can be received electronically (EDI), in paper form or as an email attachment.

The key data from a customer order is extracted automatically via the FIS OCR document reader. The data is checked for potential errors before transferring the order information to the integrated sales order monitor.

Sales Order Creation within SAP

The integrated matching process and data enrichment functions are tasked with directly converting a customer order into an SAP sales order with or without reference to a quotation or contract.

With the creation of the sales orders, additional supply chain functions such as order confirmation, shipping notification, goods issue and billing document are triggered automatically.

Customer orders that do not pass the plausibility checks successfully can be viewed by the accounts receivable team in the sales order monitor.

Functional description

- Automated sales orders creation in SAP (paper, email or EDI data records)

- Overview of all inquiries and purchase orders received

- OCR image or EDI data visualisation as a PDF form

- Full integration in SAP with all order processing functionalities

- Quick error analysis with intelligent message logs

- Direct communication with integrated mail system

For organisations wishing to

- Automate sales order creation in SAP and therefore make financial and time savings

- Reduce the degree of manual keying and administration tasks within the current process

- Make digital transformations within their current processes

Alternative to

- Standard SAP ERP

- Physical movement of financial documents

- Manual keying of order data with no validation checks

- Printing and scanning emailed sales order attachments

Further Benefits

- Higher productivity of accounts receivable teams with more functions presented in a familiar SAP standard GUI

- Software is Integrated with SAP but with no need for modifications to SAP ERP standard - quick enhancement pack and upgrade changes

- Data stored once in SAP database - no data exchanges with external software

- Efficient interrogation tools for exceptions and query management

- High financial return on investment

- Accounts receivable team directed to more value-added work as FIS / edc automates labour intensive tasks

Machine Learning applied to invoice processing

Vendor and Customer Statement Reconciliations

FIS / edc Fiori apps for invoice approval

Invoice Reading as a Service – Caravan and Motorhome Club

Technology to Automate Document Processing with SAP

Automated Invoice Reading from Day-One

Making Financial Savings by replacing manual tasks