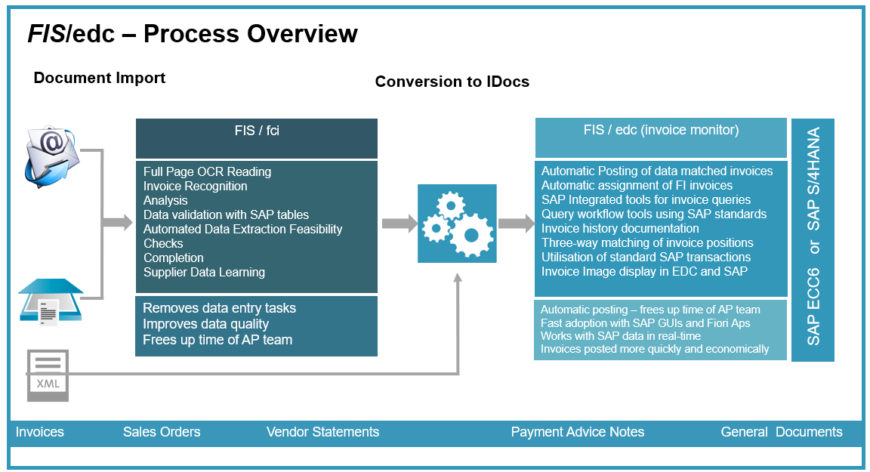

OCR invoice data collection technologies and functionality

Advanced technologies work together ensuring that invoice data is collected automatically and accurately. The invoice reader uses validation and viability checks prior to the data export to SAP or Financials.

- Replace time consuming tasks such as manual data-entry when processing invoices

- Improve the invoice data quality in SAP by utilising tables from SAP for company code identification, PO validation, current tax values, and supplier identification

- Make savings by reducing invoice processing costs, making a significant improvement in data quality

- Reduce the workload for the accounts payable team

- Reduce the payment times for vendors by processing invoices in a timely manner

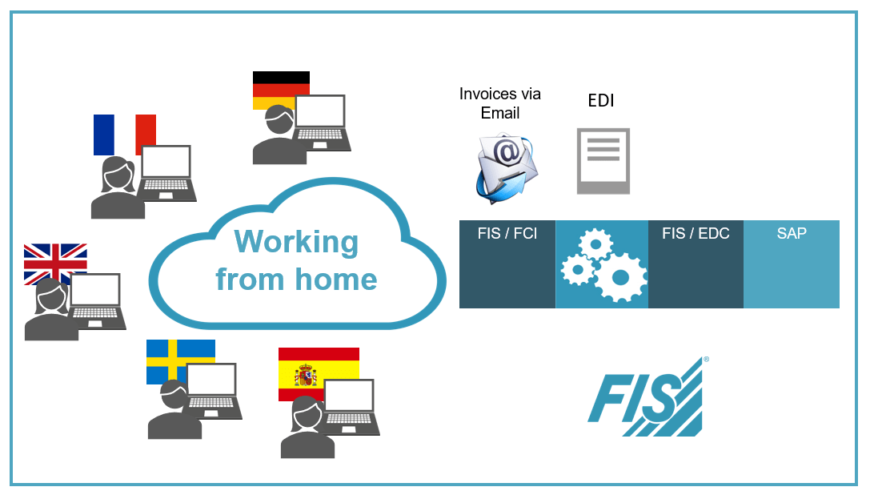

Emailed invoices are automatically forwarded to FIS / fci (the invoice data collection component) and then archived for retrieval in SAP / ERP. Therefore, no need for manual tasks such as printing, scanning and keying-in invoice data

Machine Learning applied to invoice processingReplacing manual data-entry H&S Document Archive for SAP Invoice data extraction as a service - Document OptionsFinancial savings with FIS / edcCombining OCR and SAP Integrated Invoice ProcessingOCR - Invoice Reading FAQs Invoice Processing with SAP - FAQs